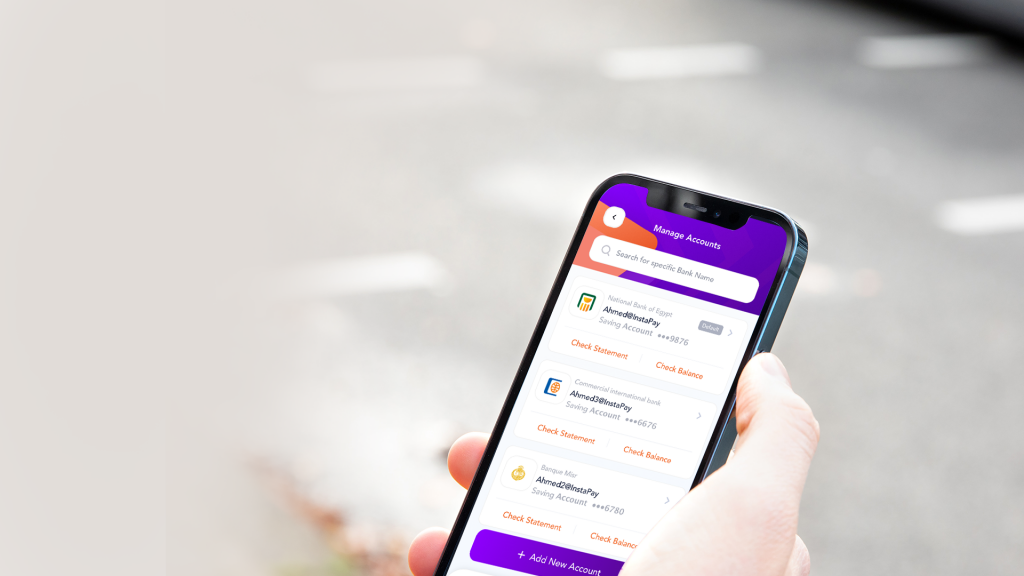

In the ever-evolving landscape of digital banking, recent adjustments by major Egyptian banks have caught the attention of many users. Two prominent financial institutions, Banque Misr and the Bank of Alexandria, are set to implement an increase in fees for money transfers through their respective electronic applications. This move is part of an ongoing trend in the banking sector aimed at aligning services and fees across platforms, especially following the changes introduced by the InstaPay platform.

Banque Misr's New Fees

Banque Misr has formally announced that its customers can expect new fees for electronic transfers conducted via its “BM Online” app. As stated in a recent post on their official Facebook page, these updates are designed to enhance the electronic payment process efficiently. Users will encounter a fee of 0.1% based on the transaction value, with a minimum charge of 50 piasters and a maximum charge of LE 20 per transaction. For instance, sending LE 500 will cost just 50 piasters, while a LE 20,000 to LE 70,000 transfer incurs the maximum fee of LE 20.

This adjustment reflects the bank’s commitment to offering a competitive digital experience, ensuring that it remains in line with the fees associated with InstaPay.

Bank of Alexandria's Approach

Similarly, the Bank of Alexandria has introduced a fee structure that features a charge of 0.15% for instant transfers via its electronic application. With a threshold starting at LE 10 and capped at LE 50, the bank aims to align its services with market trends while still providing cost-effective solutions for customers.

A Positive Shift by the National Bank of Egypt

In contrast, the National Bank of Egypt (NBE) continues to champion financial inclusion by granting users exemption from transfer fees through its digital platforms, AlAhly Net and AlAhly Mobile. This initiative reinforces the bank’s pledge to provide accessible banking services without the burden of additional costs, further encouraging the use of digital channels.

In the context of these changes, it’s clear that while some banks are adjusting their fee structures, others are seizing the opportunity to enhance user experience by providing fee-free options. These developments come at a time when increasing numbers of customers are dependent on digital banking solutions, especially in a post-pandemic world where convenience is paramount.

For many in Egypt, these changes signify the broader trends in digital banking, where maintaining competitive rates while ensuring seamless user experiences is crucial to fostering customer loyalty and engagement.

As the digital banking environment continues to evolve, consumers will undoubtedly appreciate the options available to them, ensuring that financial transactions remain efficient and user-friendly.

#Egypt #DigitalBanking #FinanceNews #BusinessNews #WorldNews